Interest-only mortgage loan: this is how it works

Are you looking around to take out a mortgage loan? Nowadays most people choose a loan with an annuity or linear repayment. But you can also choose to pay interest only, even if this type of mortgage is less common now. In this article we explain what an interest-only mortgage is, and how the right of transition works.

Characteristics of an interest-only mortgage loan

The interest-only mortgage loan has the following characteristics:

- You are not obliged to make a monthly repayment, you only pay interest

- You only pay off your mortgage in its entirety at the end of term (or you renew your mortgage loan in consultation with your money lender)

- Your monthly mortgage payment will remain low as you do not need to pay off the principal amount

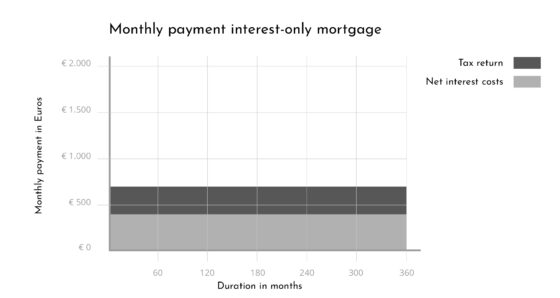

The chart on the right side is based on a mortgage loan of €300,000 at a 3% interest rate.

Redemption-free mortgage loan

An interest-only mortgage loan is sometimes also called a redemption-free mortgage loan, as you do not have to redeem your loan in principle. You only pay off your mortgage in its entirety at the end of term (usually after 30 years). But you do pay interest every month. Early repayments are certainly possible, though. Annually you can make penalty-free repayments up to a certain percentage of the principal amount. This percentage is at least 10% and may even be as high as 100% (depending on the money lender). So in the latter case you can redeem your loan entirely without penalty.

The risks of an interest-only mortgage

Of course, at first it sounds very economical to have an interest-only mortgage loan. For the term of your loan you are not obliged to repay, so you can spend the money you save on nicer things. You only have to repay the entire loan in one go at the end of term. You can do this by selling your house, or by saving enough money during the term of the loan. As an alternative you may renew your mortgage loan at the end of term and make a new agreement with your money lender about its redemption.

However, with this construction you run quite a risk of a remaining debt. If the value of your house is less than the outstanding loan at the time of (a possibly forced) sale, there is a remaining debt. So if your savings are not sufficient to fill the gap, you are in trouble.

Tip: You can imitate a mortgage loan with an annuity or linear repayment by making additional early repayments (without penalty) as you please. It diminishes the risk of a remaining debt. The limit for a penalty-free repayment is different with each money lender. Therefore you should check this before you make additional repayments and ask an independent advisor for advice. Only then can you be sure that additional repayment is an economical solution for you.

Transitory law and remortgaging

Since 1 January 2013 you are obliged to repay your mortgage loan in order to be liable for mortgage interest relief. Partly for this reason, it has often no longer been economical or possible to take out a new interest-only mortgage loan. Did you take out a mortgage loan before 2013 and are you now buying your next house? In that case, due to the transitional law, you are often able to make part of your loan interest-only.

But even if you use your right of transition you will still be bound by certain rules. For example, your interest-only mortgage loan must fulfil the requirements of the current mortgage standards, also in respect of the loan to value. Most money lenders will not allow your interest-only loan to exceed 50% of the value of the house, and this rule also applies to loans under the National Mortgage Guarantee. So the rest of the loan you will have to repay in annuities or linearly. Have you sold your house? Then you are allowed to continue the interest-only part of your loan without loss of mortgage interest relief in the current as well as in the next calendar year. After that your right has lapsed.

Redemption-happy: be advised

To prevent that people with an interest-only mortgage loan will be faced with a nasty surprise at the end of their loan term, the Dutch Banking Association started a Redemption-happy (Aflossingsblij) campaign in 2018.

The brief summary: be well advised about the possible alternatives for your interest-only mortgage loan. For example, it is not necessarily more advantageous to make additional payments. You may also change the type of (part of the) mortgage or build up extra capital to repay your loan in the end.

Want to know more?

Are you interested in finding out the best solution for your situation? Make an appointment without any obligation with one of our advisors. We will be happy to think along with you!