Annuity mortgage: this is how it works

First-time buyers can now choose from two types of mortgage: an annuity mortgage or a linear mortgage. In this article, we discuss exactly what an annuity mortgage entails. That way, you can ensure you are well prepared.

Features of an annuity mortgage

An annuity mortgage offers the following features:

- Your total monthly payments remain the same

- The sum you are paying off increases all the time

- The interest decreases all the time

- Financially, you are better off during the first years (compared to a linear mortgage)

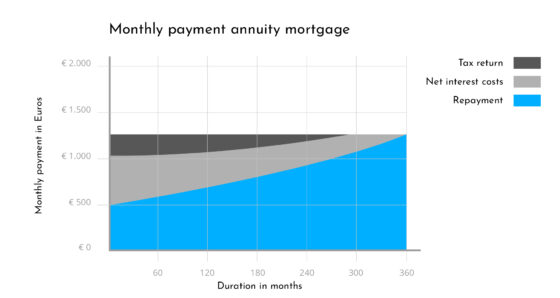

You pay the same amount every month during the fixed interest rate period. That sum consists of two elements: the interest and the loan repayment.

During the initial period, you do not pay off so much of the loan, but you do pay a great deal of interest. However, this interest is tax-deductible, which means more mortgage interest is tax-deductible than with a linear mortgage. Later, this is the opposite: you pay off a great deal of the loan, but only a little interest.

Most people opt for a 30-year mortgage term. By the end of the term, you will have paid off your mortgage in full.

Why is it cheaper in the first years?

Payment of interest and repayment of the loan are structured differently with an annuity mortgage than with a linear mortgage. Therefore, your monthly payments are lower in the first half of the term, but higher in the second half of the term.

You are also better off with an annuity mortgage in the first few years in net terms. This is because your mortgage interest is deductible from your taxable income. This tax relief keeps decreasing as the term progresses, because you keep paying less interest.

It is often suggested that an annuity mortgage is ultimately more expensive than a linear mortgage. However, it is difficult to judge whether or not this is true. It all depends on what you do with the amount you ‘save’ on lower monthly payments at the start of the term. Is the money in a low interest rate savings account or do you spend it quickly? Then a linear mortgage may indeed be cheaper. Will you invest the money in something that adds value, such as an investment or a study programme? Then an annuity mortgage may be more advantageous financially.

Overpayments are no problem

In any case, every lender allows you to make an overpayment of 10% (of the original principal sum) on your mortgage every year without being penalised. Making overpayments reduces your monthly costs immediately. You can also make overpayments on a linear mortgage. That way, you retain control and you can pay off your mortgage sooner if desired. You cannot apply an annuity payment schedule to a linear mortgage.

Is an annuity mortgage right for me?

Annuity mortgages are popular with first-time buyers on the housing market because you have lower net costs in the beginning. They often expect to earn more in time, which will enable them to keep affording the higher net costs later in the term. Make sure to consider this carefully when you make your choice. If you take your gross costs rather than your net costs as the point of departure, you will be always be right. After all, they remain the same with an annuity mortgage.

Discuss it with a mortgage advisor

However, the type of mortgage that suits you best depends on numerous factors. Our mortgage advisors can assist you in identifying these factors quickly and making a suitable choice. Schedule a no-obligation telephone consultation and we will assist you further!