Making your home more sustainable – step-by-step

Making your home more sustainable is easier than you probably think. But where should you start? Viisi has listed it for you in this step-by-step plan. Within 6 steps you will benefit from a more energy-efficient home!

In 6 steps to a more sustainable home

Step 1: Determine which measures you want to implement

List what your wishes are and what the options would be for your home. This is easier than you think. Several websites can calculate for you which measures you can take to save energy and money within 2 minutes. They do this based on the data of your home, your energy consumption and energy prices. The websites differ from each other in a number of ways:

| Website name | Who’s operating it? | Does the owner have a commercial interest? | Can you get in touch with the installers via the website? | Specifics |

| De Energiebespaarders(The Energy Savers) | Private initiative | Yes | Yes | Working together with Viisi and with mortgage lenders (Triodos, ABN AMRO, Florius) |

| Verbeterjehuis.nl | Stichting Milieu Centraal | No | No | You can also find many other tips and info about sustainable improvements |

| Woonwijzerwinkel | Various Municipalities | No | Yes | Physical stores for more extensive personal advice (at a capped rate) |

| Box Duurzaam | Private initiative | Yes | Yes | Personal approach |

You can use all of the above websites (and any other initiatives) to estimate the benefits. Overall, the results will probably be similar. Would you like to know more about heat pumps, solar boilers and other sustainable measures? Then you can read about it on verbeterjehuis.nl.

Do you want to become more sustainable, but you need to know exactly what and how? And do you want to complete your new mortgage quickly? With the Energy Savings Budget (Energiebespaarbudget), you can borrow extra for sustainability, but you do not have to choose in advance which measures you will take. You then have (depending on your lender) 1 to 2 years after taking out your mortgage to use the budget for sustainability.

Now you know what can be done and what your investments can yield, it is time for step 2.

Step 2: Choose how the work will be financed

Own money

Do you have sufficient savings? Then you can of course use your own money. Investing in energy-saving measures is often an investment that yields returns in the form of lower energy costs. This may yield more than if you leave the money in a savings account.

Make sure that you always have a financial buffer available for unexpected expenses.

Is there no (sufficient) savings available, or would you rather keep it aside as a buffer or for other expenses? Then taking out a loan, or increasing the mortgage might be a good option.

Loans

Fortunately, municipalities, the central government and some mortgage providers consider it important that homeowners experience as few financial barriers as possible if they want to make their homes more sustainable. Therefore, there are several options available to take out a loan for this. In some cases, there is no handling fee applicable.

Examples of these loans are the Energy Saving Loan (energiebespaarlening). And there are many municipal schemes, the best known of which is the Sustainability Loan.

Municipalities can offer a wide range of other schemes. At the ‘Stimuleringsfonds Volkshuisvesting’ (SVn) you can see per municipality which local schemes exist for making the home more sustainable.

Increase mortgage

It is also possible to increase the mortgage to finance the sustainability measures. Ask your Viisi advisor what is possible within your mortgage. Don’t have a Viisi advisor yet? Then schedule a telephone consultation here.

If you make the home more sustainable, the maximum mortgage may be higher than it normally is. These are the main deviations:

Based on the home value

Financing up to 106% of the market value after renovation is possible instead of 100%. The ‘extra’ 6% must then be fully used for sustainability measures.

Based on the energy label of the property

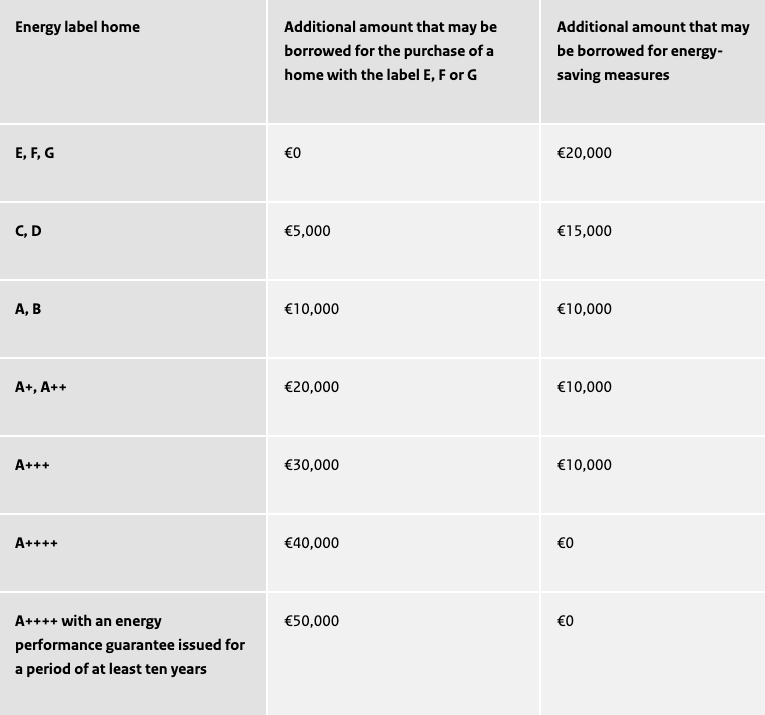

Households that purchase an energy-efficient home from January 1st 2024 can obtain additional mortgage for this. Owners of energy-efficient homes have a significantly lower energy bill, which means they have more left over for the mortgage and other expenses. The borrowing capacity for buyers of a home with an energy label E, F or G is decreasing. The table below shows what extra homeowners of energy-efficient homes can borrow.

Source: Rijksoverheid.nl

Borrow extra for sustainability

Households can also borrow an additional amount to make their home more energy efficient, as shown in the table above. There is a list of measures that almost always reduce the energy bill more than the monthly mortgage costs increase. This amount previously did not exceed € 9,000. This amount is now also differentiated according to energy label. Because more measures are required for EFG homes, buyers of these homes can borrow a higher additional amount than buyers of homes that are already more energy efficient. For EFG homes this will increase to €20,000 in 2024.

The precise implementation of these options depends on the lender. Most providers simply allow all of the above deviations, but this is not always the case. Good examples of lenders who offer options to increase the mortgage for sustainability can be found at:

- Triodos: with the Energy Saving Loan and interest rates that depend on the energy label

- ABN AMRO: offers a 0,15% discount on the Budget Mortgage and the Home Mortgage for energy-efficient homes

- ASR: offers a separate Sustainability Mortgage

- Florius: offers a comparable Sustainable Mortgage

- Vista: with an interest discount of 0.1% for homes with an A label

- Obvion: 0.05% discount for homes with an A label or higher

- Woonnu: offers the Duurzaam Voordeel Hypotheek which helps you to increase the energy label to A for a guaranteed amount

Step 3: Submit applications for financing

Based on the budget, the appraisal and financing application can be initiated. For subsidies and SVn loans, you can contact the relevant agency for information about submitting documents.

When applying for a mortgage, it is often important that the appraiser who will value the home is aware of the sustainability and any other renovation plans. The appraiser can include these measures separately in the appraisal report and estimate the market value of the home after the work has been carried out.

This renovation specification is used to communicate what you plan to do to the appraiser. You also provide this document to the mortgage provider, so that it is clear how much can be borrowed and how much money is held in a construction deposit.

Want to know more about construction depots and everything that goes with it? Here you will find more information.

Step 4: Perform work

As soon as the money is available, work can begin. We always recommend using a certified installer.

Some of the organizations in the table in step 1 can help you directly with a collaborating installer. You are free to choose an installation company. In addition to the price, the experiences of other customers and a company’s certifications are also valuable to include in your comparison.

Have you arranged financing within your mortgage? Then you can send in the invoices to your lender by using your construction deposit.

Step 5: Apply for a subsidy

Did you know there are many options to apply for subsidy? The complete overview of subsidies can be found on the website Energiesubsidiewijzer.nl. This website is managed by Stichting Milieu Centraal. There are national schemes such as the Investeringssubsidie duurzame energie en energiebesparing (ISDE)

Tip: in some cases you can apply for a subsidy for the same sustainability measure(s) from both the government and the municipality. This means stacking subsidies and extra financial benefits for you as a homeowner.

Step 6: Living more comfortably with a new energy label

Do you want to register the improved energy score, for example, to adjust your mortgage interest rate? Check how to approach this on the RVO website. If you already have an energy advisor, he can adjust the label. If you do not yet have an energy advisor, you can look for one via the Central Register of Technology.

With the new energy score, you can receive an interest discount on your mortgage from several lenders. This can sometimes be adjusted immediately, but sometimes only after the fixed interest period has expired.

Less energy consumption also means lower costs. You could therefore consider the following administrative points:

- Reduce the monthly amount you pay to your energy supplier.

- Don’t forget to include certain costs in your income tax return. If you have increased/applied for a mortgage, some costs are deductible items.

Then one last tip: would you like to see how your home scores in energy consumption and how you can reduce this consumption? Then you can download the Sustainability Profile via the button below. This initiative by various housing partners such as the National Mortgage Association, Florius and ABN-AMRO, looks at various options: better insulation, smarter heating, using the sun, etc. With the profile, you can estimate what you save and what it costs you. And – per measure – your return: what does the investment yield for you? That percentage is often considerably higher than the savings interest at your bank.

And finally: are you satisfied with your improved home and the lower monthly payment? Then tell everyone what the benefits are of making their own home more sustainable. Because the more people who get started now, the faster we will make our homes in the Netherlands more sustainable!