Rising interest rates: history and consequences

Everywhere you look, media reports are expressing the same message: “It’s been a long time since interest rates have risen this quickly”, which is definitely the case of course. But are interest rates really that high, and what effect will the interest rate rise have? We explain where the interest rate rise is coming from, and what the consequences are.

What’s causing the interest rate hike?

Let’s start with the current interest rate: the average interest rate for a 10-year mortgage with an NHG (national mortgage guarantee) is currently around the 3.6% mark. At the beginning of January, this interest rate was still around 1%, which, admittedly, is an unprecedentedly huge increase. However, if you look at it from a historical point of view, the interest rate is climbing back towards the average of the past decades.

The fixed mortgage rate depends on the long-term interest rate (10, 15 or 20 years) on the capital market, with inflation playing a major role in this regard. In order to borrow money, banks buy money from investors. These money lenders take inflation and expected monetary depreciation into account, and utilise it to determine the fee (the interest) they charge for lending their capital. If inflation is low, they can demand a low fee; if inflation is high, they will usually opt for a higher interest rate to compensate. Currently, partly due to rising energy prices, the war in Ukraine, and the aftermath of the Covid crisis, inflation is high. As a result, it costs banks more to be able to borrow money. This is passed on to consumers through interest rates, resulting in higher mortgage interest rates.

History of interest rates

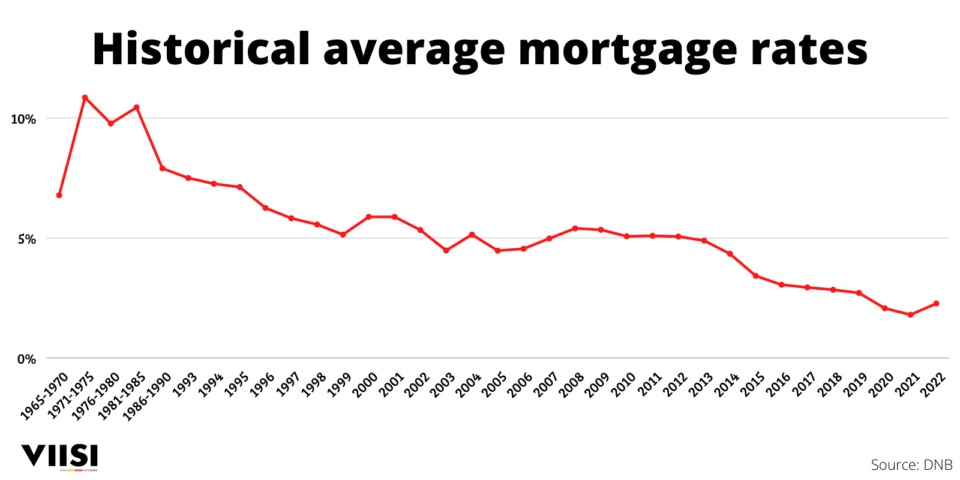

Interest rates have been monitored since the 17th century. Admittedly, that’s quite a way back in time, but if we take the interest rates gauged from the mid-1960s onwards, we can get an accurate picture of interest rate trends throughout those years. The graph shows that the interest rate climbed steeply in the 1970s and 1980s, peaking at 13.4% in 1981. Since then, interest rates have actually only decreased. From 2010 onwards, interest rates have fallen severely, with an ultimate low point at the end of 2021 / early 2022 (around 1%). With the interest rate hikes of the last few months, we are basically just returning to more normal interest rate levels after about 2 years of extremely low interest rates.

What are the effects of the interest rate increase?

You will notice the influence of higher interest rates when taking out a new mortgage, or when your fixed interest rate period expires. A higher interest rate affects your borrowing capacity. With a higher interest rate, there is a decrease in the amount you can borrow; this is because the higher interest charges take up part of your maximum borrowing capacity. However, it’s not only you who is able to borrow less, but other people as well. We are seeing increased interest rate costs already resulting in less overbidding and fewer viewings. Have you already got a mortgage, and is your fixed interest rate period not yet coming to an end? If so, then the rise in interest rates will not affect you for the time being.

Calculation example of gross monthly repayments at January 2022 and July 2022 interest rates

A higher interest rate means you will have to pay more interest every month. In the calculation below, we show you what your monthly costs would be at an interest rate of 1.06% in January, and an interest rate of 3.81% in July.

Example shows gross monthly costs with a mortgage of € 350,000, at a fixed rate of 10 years with NHG.

| January (1,06%) | July (3,81%) | |

| Gross monthly repayment sum | € 1,135 | € 1,633 |

| Total gross monthly repayment sum after 10 years | € 136,200 | € 195,960 |

| Remaining amount owed after 10 years | € 240,853 | € 270,121 |

| Mortgage amount paid off after 10 years | € 109,147 | € 79,879 |

Do not make any hasty decisions

Should we all be holding back on property purchases right now? That’s a tough question to answer. Homes are generally purchased for the long run, and are almost always a sound investment. But it is a good idea – now more than ever – to think carefully about the risks, and to limit them as much as possible. Think carefully about what you need in terms of accommodation, and what monthly costs you can, and are prepared to pay. Are you already looking to sell your home? If so, don’t be overly optimistic about the sales value of your home in terms of the bridging mortgage loan. The safest option is still to sell your house first before buying your new home. This way, you’ll build up a financial buffer and limit the risk.

The interest you’ll eventually pay depends on the risk of your mortgage. The interest rate period and the ratio between the value of your mortgage and the market value of the house play a role. For example, are you opting for a mortgage with a relatively short fixed-rate period of 10 years with an NHG? This means the risk for the mortgage lender is lower, and you’ll pay a lower interest rate. What interest rate you pay depends on the choices you make and your financial situation. With the personal mortgage advice provided by our advisers, you’ll know exactly what interest rate you can expect, and which type of mortgage is the best match for your situation.