Types of mortgages

Are you looking for a mortgage for your first home? Or for your next property? There are various types of mortgages that enable you to repay the loan you take out with a lender. We’ve put together a list of the different types of mortgages for you.

What are the various mortgage types?

For new mortgages, two mortgage types for which you will be allowed mortgage interest deduction remain as of 2013: the linear mortgage and the annuity mortgage. For other mortgage types – also known as repayment mortgages – you will no longer receive mortgage interest deduction as of 2013, unless you are able to utilise the transitional law.

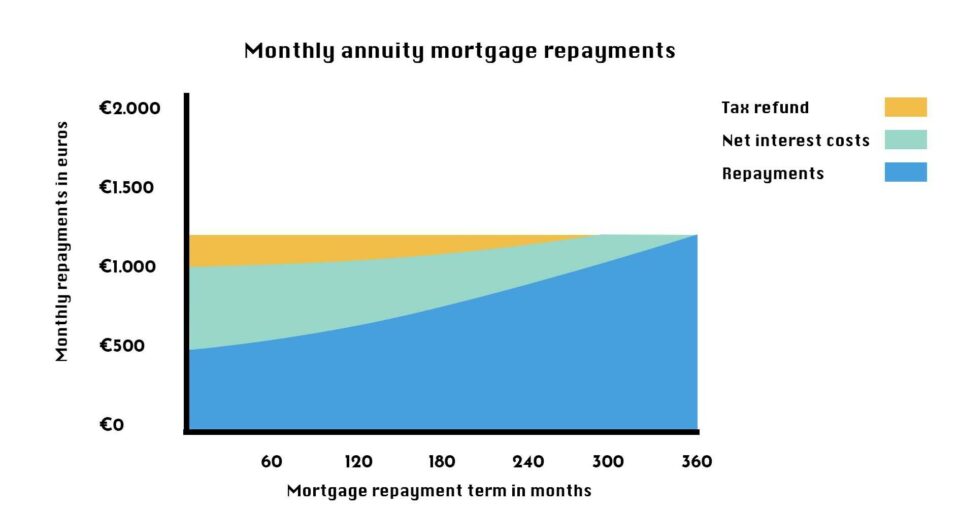

Annuity mortgage

With an annuity mortgage, you pay the same gross amount every month, whereby the amount consists of a part that is used for repayment and a part that is interest. You pay off less of the mortgage initially. To summarize:

- The gross monthly costs remain the same during your fixed-rate period.

- The net monthly costs gradually increase during the mortgage term.

- You’ll incur lower monthly payments in the first few years compared to a linear mortgage.

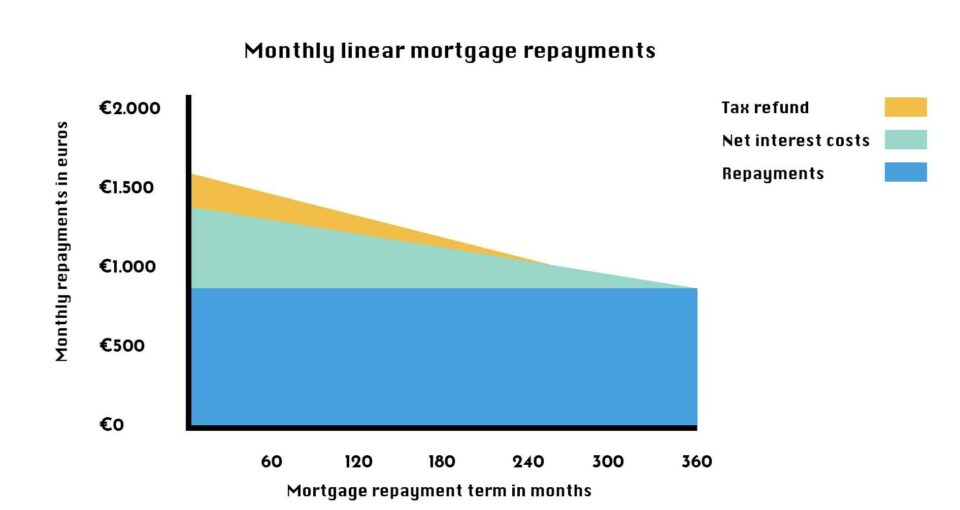

Linear mortgage

With a linear mortgage, you pay a slightly lower monthly amount every month during the term of your mortgage. That amount consists of two parts: a part that represents repayment and another part that is interest. Because you bite into a chunk of your mortgage debt every month, the interest amount decreases. To summarize:

- Every month, your monthly payments will decrease slightly.

- Over the entire term, you’ll pay less interest compared to an annuity mortgage.

Is a linear or annuity repayment mortgage type more advantageous?

You’re probably wondering: which type of mortgage will be cheaper ultimately? And which term would be the best choice for a mortgage? That depends on your situation and future plans. Our mortgage advisors can explain all this to you.

Other mortgage types

Until 2013, you were also entitled to mortgage interest deduction for mortgage types other than annuity or linear mortgages. For example, the interest-only mortgage or (bank) savings mortgage.

Did you take out your original mortgage before 2013? If so, under certain conditions, you are also entitled to mortgage interest deduction through the transitional law. For more information, please feel free to contact one of our advisors.

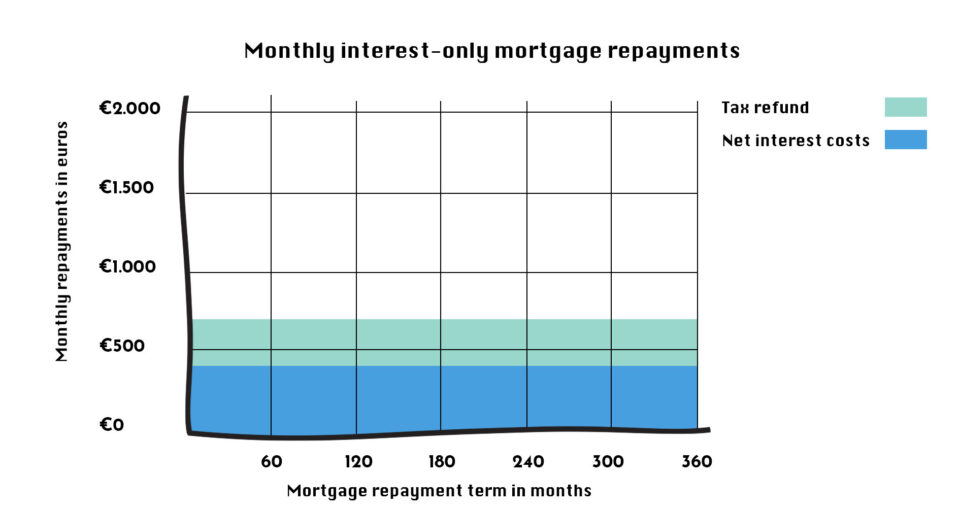

Interest-only mortgage

With an interest-only mortgage, you do not have to repay your mortgage during the set mortgage timeframe. You do pay interest every month however. Often, it’s only at the end of the term – usually 30 years – that you pay off the full mortgage. Or, another option is that the loan can be extended. Interim/early repayment is also possible.

- You do not pay a compulsory monthly repayment, solely the interest. As a result, your monthly costs are low.

- The entire mortgage is only paid off at the end of the term, or you could extend your mortgage term in consultation with your lender.

- If you are entitled to utilise transitional law, the interest is tax-deductible on your interest-only mortgage; if you do not have this option available to you, then the interest will not be tax-deductible.

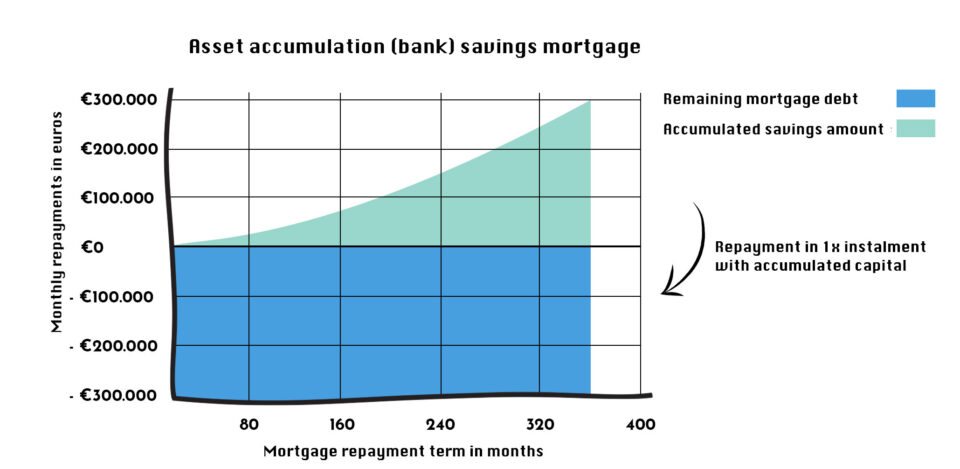

(Bank) savings mortgage

A bank savings mortgage or savings mortgage is a loan, whereby no repayments are made on the loan during the term. At the end of the term, you pay off the loan with a linked savings product. If you’re taking out a mortgage for the first time, you can no longer select this type of mortgage.

- This mortgage consists of two parts: a loan and a savings account.

- You do not have to repay the mortgage during the mortgage term.

- You will be paying mortgage interest and premium for the linked savings account.

- It’s only at the end of the term that you’ll pay off the loan in one instance with the money you saved through the linked savings account.

- No asset tax is required to be paid on the capital accrued with the (bank) savings mortgage.

Which type of mortgage is a match for me?

In the beginning, you often have higher monthly payments with a linear mortgage than with an annuity mortgage. Many first-time buyers therefore opt for an annuity repayment form. Are you planning to work less? If so, a linear mortgage might be of more interest to you. In other words: the mortgage that suits you best depends entirely on your situation and future plans, so get in touch with one of our mortgage advisors. We’ll be happy to help you.

Download white paper ‘Buying a home in The Netherlands’

Do you want to go on a home hunt well prepared? You will find all the information in this white paper.